How to Configure An Accounting System

Given all the discussion regarding Big Data, it would seem to be a good time to discuss how you configure an accounting system can help you track revenue and expenditures and generate insight regarding future business performance. From SAP to QuickBooks, most all accounting systems have some sophisticated ways of categorizing business activity. Fundamentally, there are six categories or dimensions for viewing business activity and can be used for gaining valuable insight. The first three are the ones that nearly everyone is familiar with:

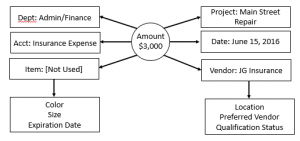

- Amount: This is the dollar value of the transaction. In this example, let’s assume we had to spend $3,000.00.

- Date: This is the date of the transaction. Let’s assume this expense was posted on June 14, 2018.

- Account: The account for this expense is Insurance Expense.

The next two are less commonly used:

- Department/Function: Even QuickBooks has the ability to categorize business activity by Department/Function using classes. Generally most businesses should categorize business activity by at least these three functions: 1) Admin/Finance; 2) Marketing/Sales; and 3) Operations. In our example, let’s assume that this cost relates to the Admin/Finance department.

- Cost Objective: The name of this dimension relates to your industry. If you are in construction, you would call this dimension a Job. If you are a government contractor, you might call this dimension Contract or Project. We are going to assume that we are in the government contracting business and this related to a project titled “Main Street Repairâ€.

Then there are master data-related dimensions, which include the following:

- Customer/Vendor

- Item: This could be a type of service in a law firm (10 hours for an associate partner) or a part number for a distributor (product ID). [Since this is an expense, there is no actual item attached.]

- Sales Rep: Invoices would be categorized by Sales Rep to track performance to plan and to assist with computing commissions.

- Work Center: In a manufacturing environment, a work center might be coded to a production transaction.

In most accounting systems you can have another layer dimensions that pertain specifically to the master record. For example, an Item could have additional fields for color, size, expiration date, etc. A vendor master record would have location, type (primary or alternate vendor), etc.

Now You Know How to Configure an Accounting System

Accounting systems have the capability to track business transactions using a variety of dimensions as can be seen above. Using various tools like SAP’s Crystal Reports or Microsoft’s Power BI, business owners and employees can substantial increase their ability to gain actionable intelligence regarding future business performance. So when you are ready to configure an accounting system, whether it be SAP Business One, QuickBooks or MAS 90, be sure to give some extra thought as to how you might use your transactional information and configure your master data to support your vision. If you need assistance from an experienced CFO, contact Profitwyse today.