Self Paced Learning Opportunities

Unlock Financial Stability: Master the Art of Crafting and Managing to a 13-Week Cash Flow Model

Have you ever found yourself pondering the puzzling scenario where your P&L showcases a positive Net Income, yet your bank account seems far from reflecting it?

Are the influences of accounts receivable, inventory, and/or accounts payable on your business bank balance akin to ‘an enigma wrapped in a mystery‘?

Imagine unraveling the mysteries of cash flow models, dissecting them on a weekly basis to dissipate the fog surrounding this crucial topic.

Embark on a journey with our Self-Paced course, ’13-Week Cash Flow Modeling.’ Equip yourself with the knowledge to navigate these intricacies and embrace the newfound confidence that accompanies financial stability.

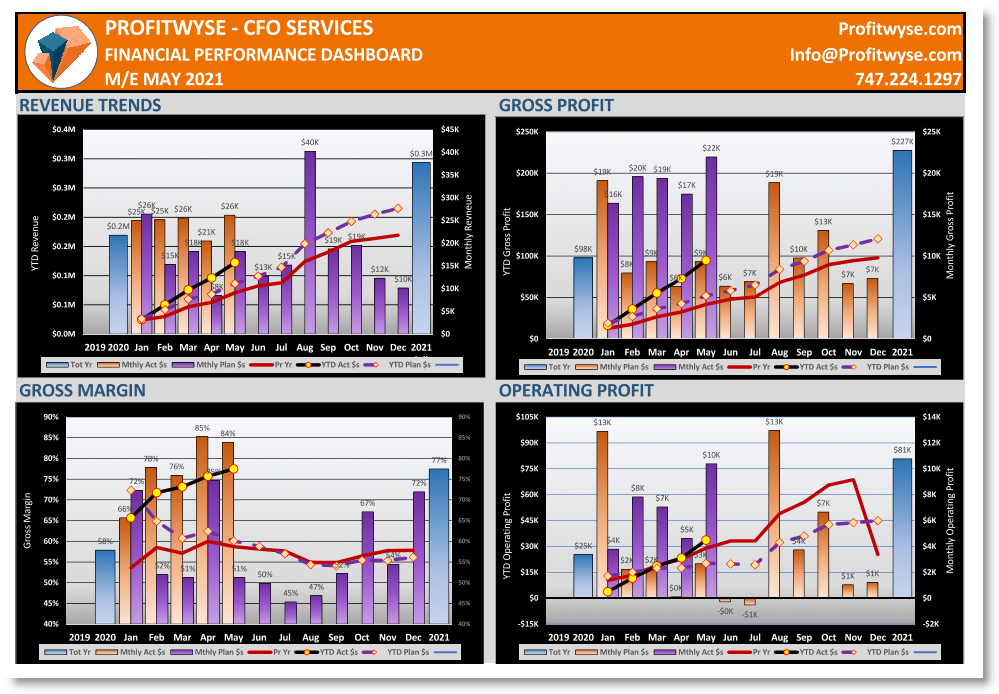

Build and Utilize a Financial Dashboard to Align Goals and Teams

Dashboards serve as proven management tools, playing a crucial role in fostering accountability and assisting business owners in attaining revenue growth, profitability, and enhanced cash flow.

We meticulously outline the step-by-step process for creating these invaluable financial results dashboards, utilizing the same approach that we successfully apply with our clients. Gain insight into the inner workings of our process as we meticulously dissect each stage of dashboard development.

Within the article, you will also have the opportunity to request a copy of the dashboard template for your own implementation.