TABLE OF CONTENTS

- Cost Accounting 101 – Pulling together the manufacturing P&L

- How to create unit-level standard costs

- Extending the unit-level standard costs to create the monthly cost of goods plan

- Determining gross profit and gross margin to improve profitability

- How to compute manufacturing variances and scrap plans for manufacturing businesses

- Pulling together a Profit and Loss statement for a manufacturing business

- How to validate a manufacturing Profit and Loss statement do your detail planning assumptions

Creating a Profit and Loss Statement Template for a Manufacturing Business

Cost Accounting 101 – Pulling together the manufacturing Profit and Loss Template

Creating a profit and loss statement template for a manufacturing business can seem daunting at the outset, but really it is a function of understanding manufacturing cost accounting. We have produced this series of four sessions, (see links to other three below) to provide the basics you need to generate insightful manufacturing profitability analysis. This primer on creating your Profit & Loss Statement pulls together what was discussed in earlier. If you need to better understand how to create your own Direct Labor Rates, Earned Hours and Direct Headcount Plan and/or compute Overhead Utilization variances, which will be helpful to fully understand this primer, please see following posts that preceded this culmination on our manufacturing cost accounting skills primer:

- How to Compute Direct Labor Rates

- How to Compute Earned Hours and Direct Headcount

- How to Compute Overhead Rates and Utilize Variances

In this fourth and final post in the series, we are going to pull all the different facets required to generate a Profit & Loss statement template for a fictitious manufacturing company, including the revenue plan, cost of goods plan, and the typical manufacturing variances–scrap, overhead absorption, direct labor efficiency variance, etc. With this basic knowledge, you will be able to assemble a fairly detailed profit and loss plan that can be used to provide deep insight into accounting for a manufacturing business focused on performance and necessary corrective actions.

How to create unit-level standard costs

Standard costs in most manufacturing environments consist of three components: 1) Direct Labor; 2) Direct Material; and 3) Overhead. Depending on the manufacturing processes required to produce a finished good or subassembly, there may be other cost components, such as outside processing costs. In our example, we will only focus on the three costs above (Direct Labor, Direct Material and Overhead) for this exercise.

Again, for our fictitious company we have assumed that our standard costs will not include the cost of scrap and yield or in cost accounting lingo be “unyielded standards.” Standard costs can be computed with the cost of scrap and yield “baked” into the standard as well as excluding scrap and yield. “Baking” the cost of scrap and yield into a standard cost is beyond the scope of this post, but will potentially be addressed at a later date if our readers let us know that it would be helpful.

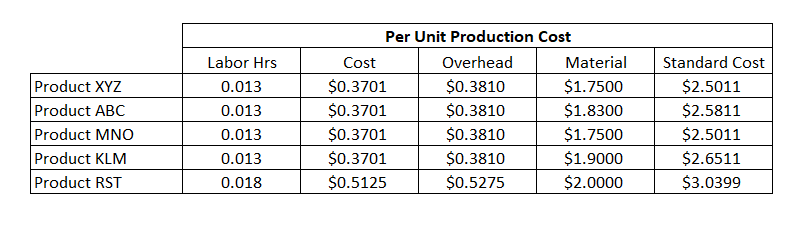

From the chart below, you can see our universe of only five products, the assigned direct labor hours required to produce one unit, the direct labor cost, overhead burden, direct material and the total Standard Cost. If you have a large universe of products, you will want to limit the number of items you use in your plan by selecting a representative part from each subsection of the product hierarchy. Then you want to apply the entire forecast volume for that product hierarchy subsection to the representative part.

In this example, the first four representative parts have a 0.013 hour labor standard, which is then multiplied by the Direct Labor Rate of $18.31 that was computed in post on how to compute a direct labor rate, giving us our $0.3701 unit cost. Next, multiplying the Labor Hours for each product by the hourly overhead rate we developed in how to compute overhead rates and utilize variances we get $0.381 per unit. The final piece is the direct material cost, per unit, which for Product XYZ was $1.7500 to get the total $2.5011 standard cost. We just duplicated the same process to get the other four standard costs.

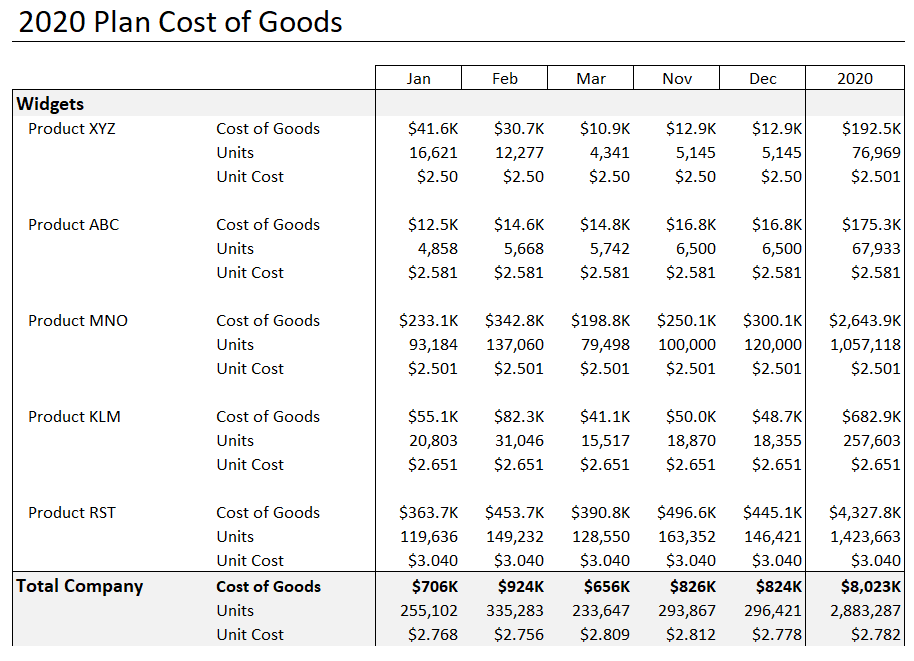

Extending the unit-level standard costs to create the monthly cost of goods plan

Once we have our unit standard cost, we can extend the unit costs to the shipment volumes to compute the planned cost of goods that is needed to complete a profit and loss statement for a manufacturing business. Looking at the image below for Product XYZ in January, you can see that we were planning to ship 16,621 units. We then multiply this amount by the unit cost of $2.5011 to arrive at the cost of goods for Product XYZ, which is $41.6K. Remember that this cost of goods represents our standard cost excluding any variances for scrap, yield, etc. Accumulating all the different representative part shipment volumes, times each product’s standard cost gives us a total cost of goods for 2020 at $8,028K (see the Total Company section at the bottom of the example below).

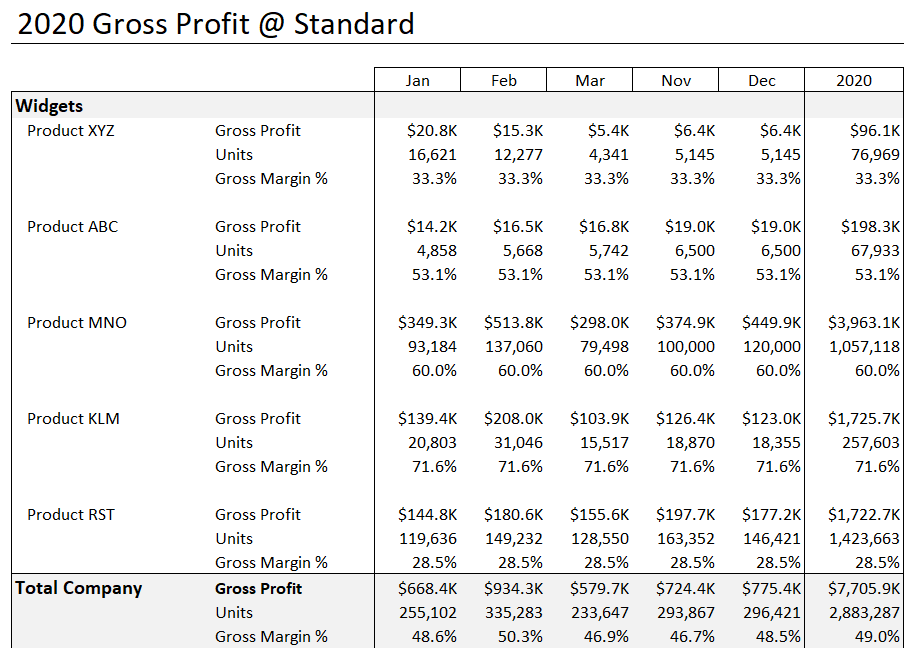

Determining gross profit and gross margin to improve profitability

The next step, which is not much of a step, is just creating worksheet that subtracts the cost of goods from the revenue projection for each product as show below. This is titled “Gross Profit @ Standard” given that it just represents the difference between revenue and standard cost, ignoring the effect of variances. So this just represents price minus standard cost. The best way to improve cost at this level is to increase price or Average Sales Prices (ASP). At this point, your sales and marketing teams should be weighing in on whether the 49% gross margin ( and/or gross profit $7,707.9K) is adequate to support a viable business. If Operating Expense combined with interest expense is greater than 50% of revenue, then there is a problem with pricing. Costs may also be an issue, but there is much more leverage with pricing than with cost, to improve margins.

How to compute manufacturing variances and scrap plans for manufacturing businesses

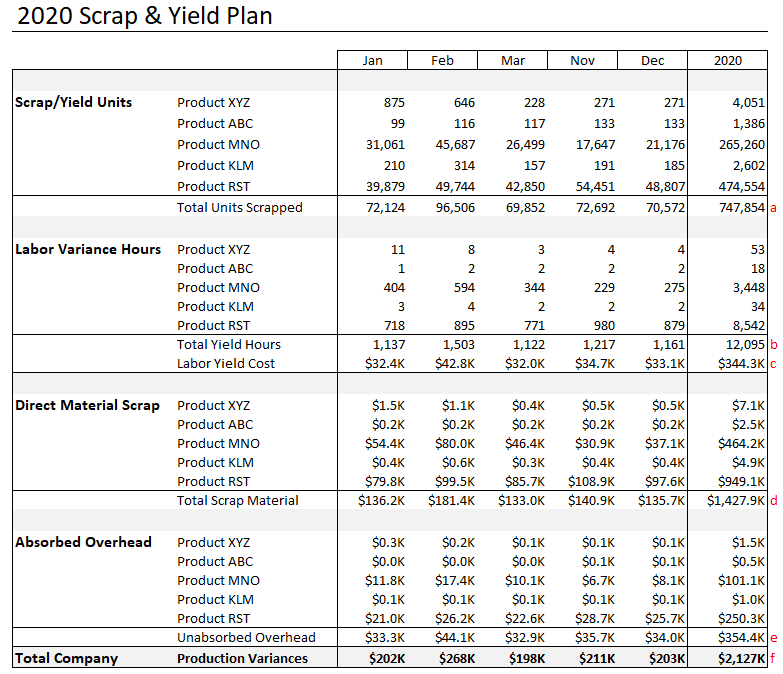

Computing the production variances is a little more complex, but still fairly straightforward. Again, scrap and yield are not “baked” into the standard costs in our example; consequently, we will see the related variance expense (scrap, yield, efficiency and absorption) posted to the profit and loss statement each month in the variance section rather than cost of goods. So on a monthly basis, comparing actual variances to planned variances will provide very meaningful insight into how your operation is operating vs. your plan and goals. The Variance Plan, which totals $2,127K, is as follows:

Here is how each category is computed:

- Scrap/Yield Units: As you will recall, each of the products has a scrap factor that was used when we computed the earned hours plan in the post on how to compute earned hours and direct headcount. For example, Product XYZ had a 95.0% yield factor (or 5.0% scrap). This means that in order to finish 100 units we have to start slightly more than 105 units (105.26 to be exact, but we are dealing with integers and are rounding). So the first section just represents the number of units to be scrapped or stated differently, the difference between planned starts and planned finishes, which equals 5 in our previous example. The Scrap/Yield Units section just reflects the total units scrap, by product, by month, with the total reflected at row a.

- Labor Variance: We are assuming that every unit, whether scrapped or not, will require the standard amount of labor. For example, in January we need to finish 16,621 units of Product XYZ. With a 95% yield, we will have to start 17,496 (16,621 finished / 95% yield) units, the difference being 875 units, to get the 16,621 finishes. The direct labor associated with the 16,621 finishes will be absorbed into inventory through the work order confirmation process. But the direct labor work force also worked on 875 units that were scrapped, per the plan, at 0.013 hours per unit totaled 11.375 man hours, equating to $324 (11.375 hours * $28.47 hourly direct labor rate) of planned direct labor inefficiency. So the plan above first computes the direct labor hours by product and multiplies the total hours, at row b, by the $28.47 hourly direct labor rate to get to the $334K planned labor efficiency variance at row c.

- Direct Material Scrap: Direct Material scrap is again taking the planned units to be scrapped and multiplying by the standard cost (or planned average cost depending on your costing methodology) for the direct material. So in the example above we planned to have 875 units scrapped in January, with a unit cost of $1.7500 (see the section above regarding computing individual cost standards) is $1,531 of planned Direct Material Scrap. The total planned scrap at row d is $1,428K.

- Absorbed Overhead: Again, given that we are not going to be adding the cost associated with scrap to our standard costs, there is going to be unabsorbed overhead expense. If you go back to our earned hours calculation, you will see that increased the number of direct labor hours by the yield factor for each product, which came to 56,696 direct labor hours. And if you go back and look at our overhead rate calculation, you will see that we used the 56,696 direct labor hours as the denominator to derive the $29.304 hourly overhead rate. Well not all of the 56,696 hours of direct labor are going to be absorbed into inventory because of scrap; consequently we have to account for the unabsorbed overhead, relating to scrap, in our Profit and Loss Plan. So we just compute the monthly labor variance hours by our $29.304 hourly overhead rate to get estimated amount of unabsorbed overhead that is assumed in our earned hours forecast. This will be added to the overhead absorption variance we discussed when we calculated the overhead rate. The former overhead absorption variance was mainly due to the timing differential between our monthly earned our projection and the monthly spend plan for our overhead department.

Pulling together a Profit and Loss statement for a manufacturing business

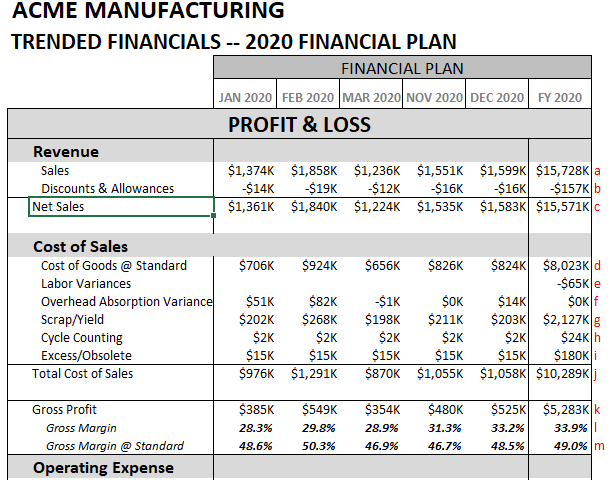

At this point, we have computed all the various components of our Profit and Loss plan through cost of goods, which is really the most complicated part of the process. Here is the final result:

Here is where the source data came from for each row:

- Sales (a): This was computed in our earlier post on how to calculate earned hours, where we created our 2020 Revenue Plan for the five products with volume and ASP assumptions by month for each part.

- Discounts and Allowances (b): This was just a straight 1% of Gross Sales.

- Net Sales (c): Just Sales or Gross Sales less our Discount Allowance.

- Cost Goods @ Standard (d): This is the just the units shipped times each product’s standard cost that was described earlier in this post.

- Labor Variances (e): This also was computed in our earlier post on how to calculate earned hours, where we created our direct labor headcount plan for employees and contract labor.

- Overhead Absorption Variance (f): This was computed in our earlier post on how to compute overhead rates. The variance relates to the timing difference between monthly earned hours and monthly overhead spend.

- Scrap/Yield (g): Scrap and Yield is a combination of the Material Scrap, Labor Variances (unabsorbed due to scrap), and Overhead Scrap-Related Absorption Variance. The total of these three items is $2,127K. Review the 2020 Scrap/Yield Plan earlier in this post for details.

- Cycle Counting (h): This is an estimate of the monthly expenses required to maintain a provision for potential cycle counting adjustments.

- Excess/Obsolete (i): Like cycle counting, this is an estimate of the monthly expenses required to maintain a provision for potential excess and obsolete inventory.

- Total Cost of Goods (j): This is just the sum of the cost of goods @ standard plus all the variances.

- Gross Profit (k): In this instance, Gross Profit is Net Sales minus Total Cost of Goods. This is a very important metrics, because Gross Profit represents the dollars available to support Operating Expenses, debt repayment and interest expense.

- Gross Margin (l): Again, another important metrics that can be used to benchmark this business again other similar businesses in this industry. It is Gross Profit divided by Net Sales.

- Gross Margin @ Standard (m): This is computed by subtracting just Cost of Goods @ Standard from Net Sales, and then dividing the product by Net Sales. This is the margin that is strictly due to pricing vs. standard costs, with any effects from Production Variances. It is good metric to track the business’ pricing power.

That is basically it for all the components of Gross Profit for a manufacturing business. If you would like to view a discussion on to breakdown Sales and Gross Profit variances into volume, price, cost and mix, see our post titled How To Generate Effective Gross Margin Analysis where we describe the various calculations needed to parse a plan vs. actual gross profit variance.

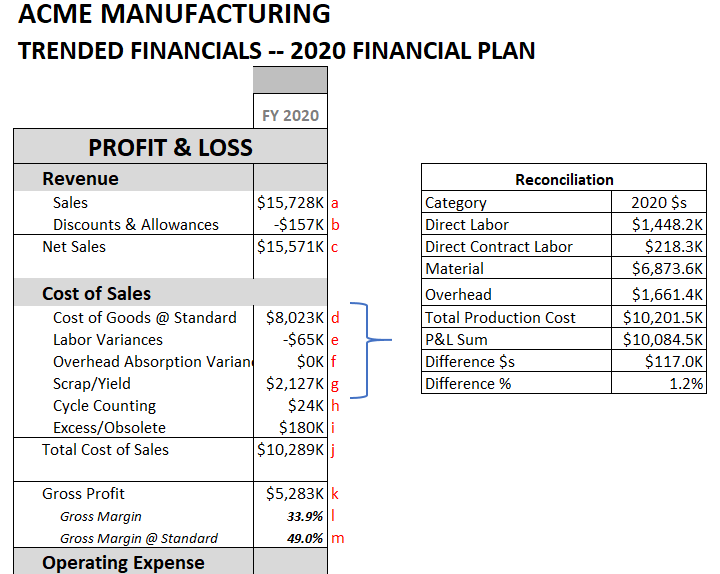

How to validate a manufacturing Profit and Loss statement do your detail planning assumptions

Once you have assembled your Profit and Loss plan, it is a good idea to reconcile all your manufacturing costs–Direct Labor, Contract Labor, Direct Material and Overhead–against your Profit and Loss Statement to validate that you have capture all the expenses. Here is an example:

You can see from the above reconciliation that we are comparing the total cost of goods to a simple summation our our Total Product Costs. There was a slight discrepancy, that with additional effort we could eliminate, but for the purposes of this blog post, as we used to say, “it is good enough for government work.”

As we stated at the outset, creating a profit and loss statement plan for a manufacturing company can be daunting. But following our roadmap above, you it will be much more straightforward.

We hope fully you found this enlightening and can utilize it in your own organizations. If you need help setting up your cost accounting processes, please give us call. If you would like a copy of any of the workbooks used as examples, feel free to reach out. We have the tools to help you overcome the financial management obstacles that can inhibit growth.

Other relevant posts: