Learn How to Create and Utilize a 13 Week Cash Flow Model

10 Lessons | 1.50 Hours of Video Content | 8 Excel Workbook Examples To Explore and Modify

Purchase Course $85.00 For 3-Months Access

What You Will Learn From This Course

This course is designed for any Accountant, Financial Analyst and even Business Owner that is seeking proven methods of projecting, monitoring and analyzing cash flow. The 13 week cash flow model has been long used to better monitor and control a business entity’s most important asset–Cash.

Here’s a summary of the different sections of this course:

- We start with two lessons on gathering historical information you will need to begin your projections. One lesson focuses on gathering expense-related information. The second section focuses on methods of projection Income/Revenue for both business-to-consumer and business-to-business type entities and importance of the Days Sales Receivable (DSR) metric in this process.

- Next, we utilize what we learned about Expenses and Income in the prior section and build out our 13-week cash flow projection, using Excel, with a focus on leveraging DSR to estimate the accountants receivable balance and cash receipts. Then we duplicate the projection worksheet to create method of tracking our actual income and expense results, as well as a variance worksheet that compares the projection to actual results.

- Then we will review an example where we have collected several weeks of actual results and analyze the differences/variances in expense and income activity to better elaborate on how one might gain actionable intelligence from those differences. The actionable intelligence gained from the first effort can be put to use in subsequent cash flow projections that will improve accuracy and confidence in the process.

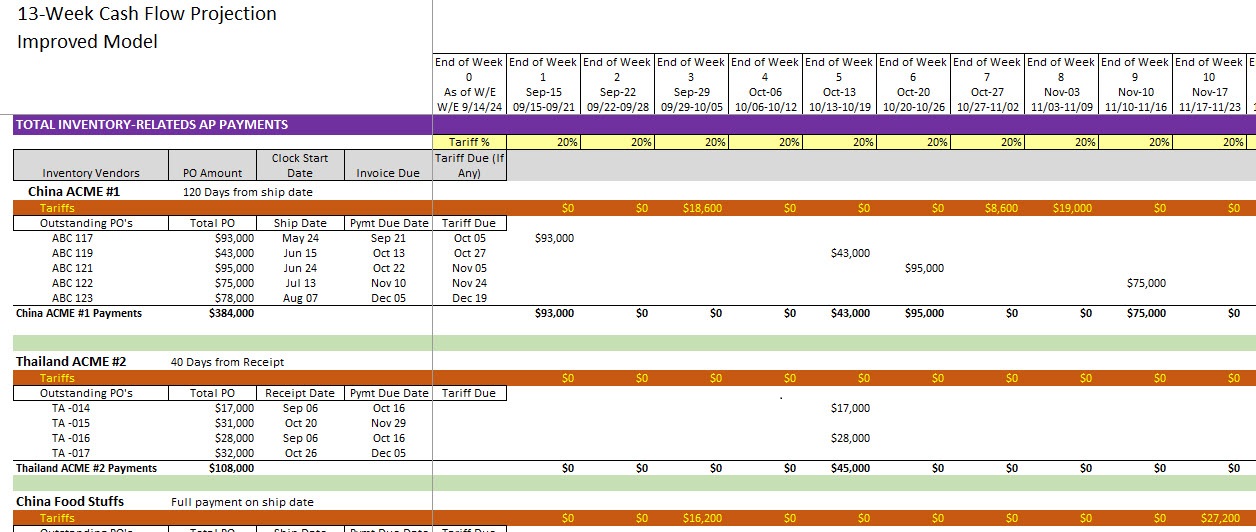

- The initial example provided is intentionally simplified to make the concepts easier to grasp. In this final section, we significantly expand the income and accounts payable projection models to reflect a more “real world” scenario of how a distribution company might go about developing a 13-cash flow model. We cover how to develop the projection, results and variance models, just like in the earlier example.

Each section contains the Excel workbooks used in the examples with all the formulas used to help you duplicate the methods used in your own application. All purchasers of our course eligible for a 30-minute consultation so we can response to any questions by scheduling time on our calendar.

Who Will Benefit From This Course

This course was developed for both accountants and financial analysts that have experience working within their respective accounting systems and are able to pull detail reports on historical expenditures and have access to their employer’s accounts receivable and accounts payable subledgers. These users need to be able to generate reports and then incorporate that information into an Excel workbook. The examples in our course assume an intermediate level of Excel knowledge to modify the Excel examples to suite our specific business needs.

In our lessons, we are utilizing a QuickBooks Desktop sample file to demonstrate how to export historical spend and income history that can then be incorporated into our projection. If you are not using the QuickBooks Desktop application, then you will have to modify historical data export process accordingly.

Business owners and other senior leaders can benefit from this course by learning some of the methods used to project expenses and especially income. If they also have the detail knowledge with both Excel and their accounting system, then duplicating our process should be relatively straightforward. Please contact if you have any questions using our Contact Us page.

Purchase Course $85.00 For 3-Months Access