The Value of Business Benchmarking To Your Company

What is the Value of Business Benchmarking Your Company

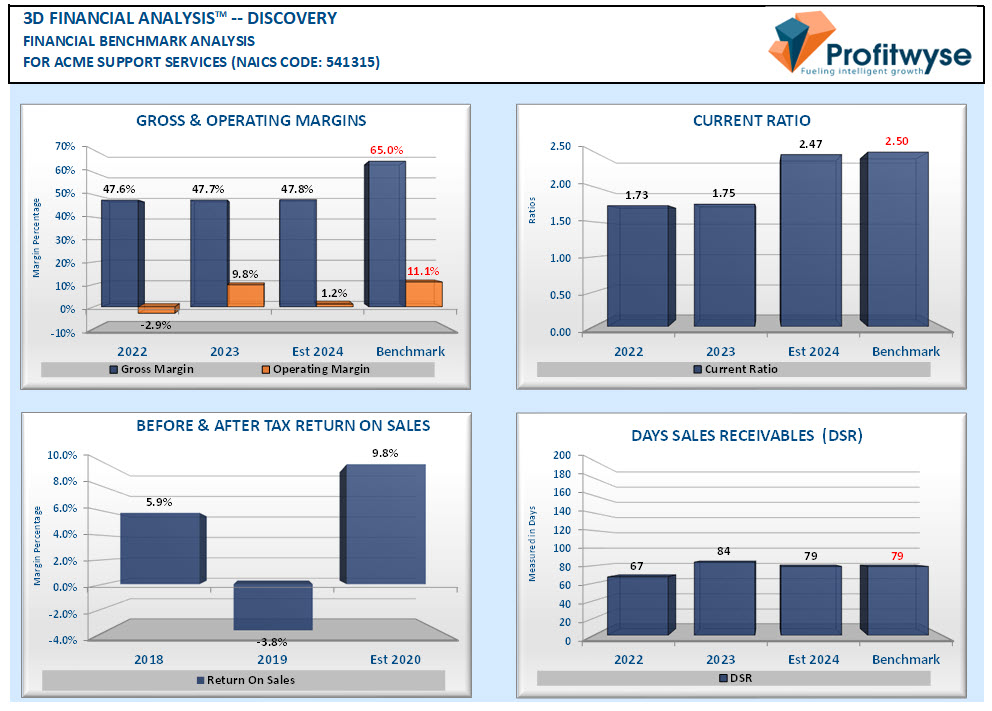

Is benchmarking an integral part of your strategic planning process? If not, you may want to consider adding a review of your industry’s key financial metrics to your next planning session, because the value of business benchmarking can be quite significant. For example, what if you discover that your industry days sales outstanding benchmark is 25% faster than your collection metric? There may be something amiss in your assumptions, relative to the terms you provide, relative to your industry. What could you do with the additional cash flow generated via a 10% improvement in collections? How about 20%? What is your competition doing with their excess cash? Similar holds true for DIOH industry benchmarks and DPO industry benchmarks. Perhaps your competitors are using their surplus cash to develop new products/services that would detrimentally affect your market share. Yikers!

Just as you look to your industry for comparisons, you should be looking at different departmenst and plants within your own organization for similar opportunities. Is one sales rep more successful selling product A than another? Is one deparment more successful renewing contracts than the other departments? Is one plant able to meet and exceed quality standards with fewer resources? These are the things that benchmarking can help you ascertain. Once identified, you will then want to replicate best practices across the organization.

How To Benchmark Your Company

To get started, begin looking within your industry. Try to summarize your company data quarterly for two to three of years to help you identify positive or negative trends. You will want to select a broad measure to start, such as return on assets employed (ROAE). ROAE (net income divided by total assets employed) is a great measure of efficiency, because the metric reflects how efficiently a business is deploying the assets that have been provided by shareholders and lenders.

Places to look for industry-based benchmark metrics include industry trade associations, look up 10K filings for similar companies in your industry on the SEC’s EDGAR website, or do what I do, refer to the Almanac of Business and Industrial Financial Ratios (ABIFR), from CCH:

The ABIFR is organized by major NAICS codes, which means that not every NAICS code is represented; consequently, you will need to find a close match if an exact NAICS match is not available. Within each NAICS code, companies are categorized by asset size. Some of the metrics include: There are 50 metrics presented for each industry, including: 1) Operating Income, 2) Cost of Operations; 3) Operating Margin; 4) Average Net Receivables; 5) Average Net Inventory; 6) Average Total Assets and many others.

Metrics that balance profitability and efficiency are best benchmarking choices, rather than more narrow alternatives, such as gross profit %. For example, companies can “game” gross profit % in the near term by extending overly favorable terms, such as longer than standard collection terms, in comparison to their industry competitors.

Once you start analyze your company’s performance to industry benchmarks, you are going to want to begin digging deeper to see what components of ROAE are the performance drivers of your competitors, e.g. how are competitors performing on inventory turns, days sales outstanding, profit margins, etc. All this analysis can then be fed back into your strategic planning process.

Benchmarking Within Your Company

As we mentioned earlier, an excellent source of performance improvement opportunities can be derived by benchmarking your own organization. By comparing one organization to another, we are always surprised by what we find. There are nearly always centers of excellence in every organization. You just need to find them and figure out how to duplicate their success. Here a few benchmarking tips on leveraging your centers of excellence:

- Use a corporate team to do collect the data;

- Try to find one best in class item within each business unit;

- Don’t spend time trying to figure out why one process works better than another, so much as just getting the process duplicated;

- Provide ample opportunities for recognition; and

- Monitor & report results to the teams.

One great byproduct of benchmarking is the competition that ensues. Just the competitive nature of most directors and VPs is enough to gain 5% to 10% of improvement, as performance metrics begin to be collected, even before the benchmark findings are tabulated. But once the findings are established and the best practices begin to take effect, you will want to figure out how to reset the bar, because your internal benchmarking needs to become the foundation for your continuous process improvement efforts. And finally, your compensation program will need to be adjusted to align with some of the benchmarking efforts to keep everyone’s eye on the ball.

We know this is a brief explanation of this important process, but hopefully there are a couple of nuggets that helps you grasp the value of financial benchmarking that will push your efforts forward. If you need help setting up ways to benchmark your organization, please give us call. We have the tools to help.