Strategic Financial Planning & Analysis Know-How

How to Value a Business

There are many ways to value a business, but a good place to start is using the Earnings Before Income Tax, Depreciation and Amortization (EBITDA) financial metric. This is a good place to start because many businesses are purchased based on multiples of EBITDA. This is because EBITDA is a good proxy of cash flow and most businesses on purchased on their ability to generate positive cash flow (or EBITDA). Is this Lesson we go into some depth on how to compute EBITDA for your business and what you can do to influence EBITDA is ways that will increase your valuation.

What Your Business Plan May Be Missing

In this lesson we recapitulate a number of good insights that were authored by Jayson Demers in Entrepreneur magazine a while back. There’s also a link to the original article, if desired. Just the same, the points that we summarize are very relevant rules that any business owner should abide by. Or as was so eloquently stated in the Big Lebowski:

“For The Dude, there is only one way to go through life, and that’s to remember a simple rule: The Dude abides. Life will always give you ups and downs, but you just have to bowl wit the punches.”

This article is contains business corollaries that are useful when generating business plans.

Gaining a Competitive Advantage — Secret Revealed

We have attempted to distill, what we term, the Competitive Edge into a formulaic representation or mnemonic that summarizes key business factors. Here’s the Competive Edge formula:

Competitive Edge = F (EO, MI, EI, BM) + S (PM, SR) + M (R2, ER)

Check out the article to better understand how your business can gain Competitive Edge.

Don’t Let Cost of Goods Sink Your Exit Plan!

We address a common concern that business buyers may have when performing due diligence on a prospective acquisition that can easily be overcome by proper use of accrual accounting. This is especially true for product-based businesses, such as manufacturers and distributors.

This issue pertains to the the level of fluctuations in cost of goods and leads to large fluctuations in gross profit and most noticeably gross margin. Wild increases and decreases can cause business profitability to appear more at risk that it actually would be if the business just made better use of accrual accounting techniques.

7 Steps to Improved Professional Services Profitability

Continuously focusing on Professional Service Profitability needs to be a categorical imperative for all professional service firms. Improved profitability generates greater gross margins and eventually more cash flow, which should be the goal. In this Lesson, we go over a 7-step process that can be used to focus both on direct labor rates and overhead absorption, which are both key components of improving Professional Service Profitability.

How to Use Return on Equity (ROE) to Super Charge Your Business

Using Return on Equity (ROE) to analyze your business performance is much like a mechanic using a scanner to diagnosis what is ailing your car. This approach was pioneered by the DuPont corporation many decades ago, but still is relevant today. The DuPont Analysis (or formula) can provide valuable insight and keys to business performance improvement for entities both large and small. In this Lesson you will learn how to apply this formula to your own business as well as methods of optimizing performance through the use of Excel Solver.

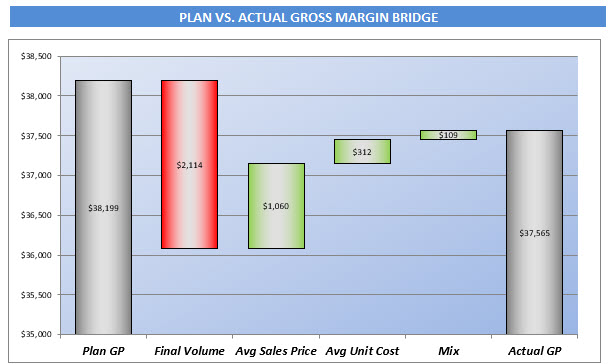

9 Steps to Generate Insightful Gross Margin Bridge Using Excel

Understanding what is underpinning gross margin variances of actual results to a plan or prior actual period is another categorical imperative for business owners, financial analysts and accountants alike. With the knowledge one can gain from analyzing a gross margin bridge, corrective actions become readily apparent, enabling swift correction efforts.

If you want to better understand what is driving gross profit and margin, such as volume variances, cost variances, price variances, etc, then you need to utilize this Lesson today.

6 Reasons Why Financial Planning Matters

A great deal of the Allied Forces success on D Day can be attributed to detail planning (as well as strategy) that was overseen by Dwight Eisenhower. Eisenhower was a proponent of planning, not just as an end in of itself, but the importance of the actual process that required focused thinking.

It his Lesson, we cover 6 reasons why financial planning is important to your business endeavors. Again, it is not just the plan but the process of thinking through options, associated costs, tactics and strategies that enable a business to achieve important goals and break through barriers.