General Accounting Skill Development

The 5 C’s of Credit and Getting a Loan

As accountants, you should understand how banks view financial statements when assessing a business’ creditworthiness. In that vein, this article provides guidance on the importance of understanding the 5 Cs of credit: Character, Capacity, Collateral, Capital, and Conditions. Character, assessed through FICO scores, reflects credit history, with lower scores suggesting eligibility for SBA financing. Capacity evaluates the business’s ability to repay the loan, focusing on the debt coverage ratio to predict available cash flow. Collateral may be needed for larger loans, often utilizing accounts receivable, inventory, and the business owner’s personal assets. Capital examines the borrower’s equity in the business, essential for proving commitment. Finally, Conditions focus on the business environment, preferring ventures in growing markets with diversified clientele. Learn more by delving into this article.

Six Reasons for Diligently Closing the Books

Though our consulting practice, we see many new clients under valuing the importance of closing the accounting books on a timely and consistent basis. This lack of a focused close leads to a number of e lack of a focused accounting close can lead to number of detrimental impacts that will drag on revenue growth, negatively impact profitability and cause poor decision making. Learn more detail on the impact on this business imperative and diligently closing the books should be a high priority for every organization.

6 Eye-Opening Questions to Ask Your Controller

As CFO Consultants, mentoring our client’s Controllers and other accounting staff is critical to the success of our engagements. As a starting point with new clients, we have developed the six questions referenced in this article to help identify potential weaknesses that need addressing to improve the eventual outcome of every engagement. In this article we list the 6 questions and explain why they are relevant to the success of any accounting team.

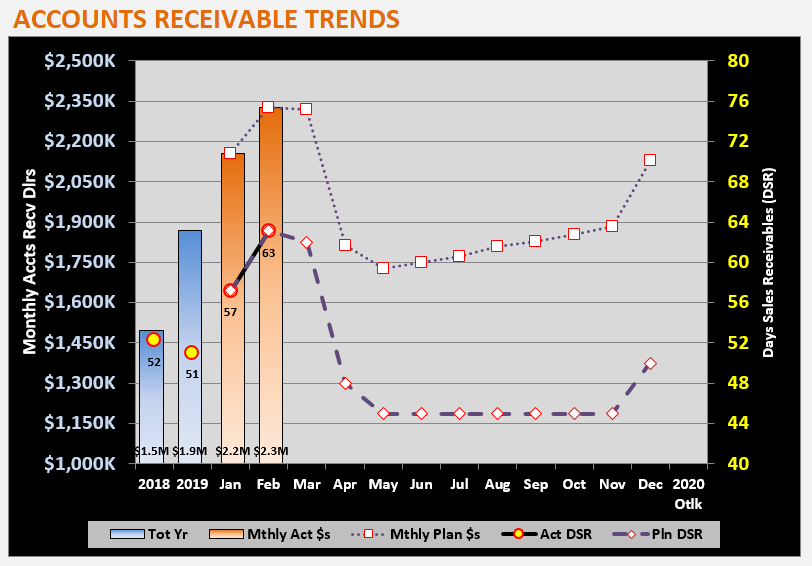

How to Compute Days Sales Outstanding (DSO) and Improve Cash Flow

Cash if the life blood of every business and there is no more important source of cash than Accounts Receivable. Managing Accounts Receivable typically starts with aging reports of outstanding receivables, buy by utilizing DSO as a metric enables you to see trends in collections as well as monitor how business process changes are impacting cash receipts. For example, collections terms can have a big impact on cash flow. To understand the impact of negotiating more favorable collections terms, you will want to monitor trends in DSO. To learn more about how to use DSO, delve into this article and start accelerating cash receipts.

How to Compute Days Payable Outstanding (DPO) and Improve Cash Flow

Once you understand the application of DSO to your business, you need to gain an understanding of Days Payable Outstanding, which is the flip side of the coin to DSO. Where you want the lowest possible DSO above to improve cash flow, DPO is the opposite in that you want the highest (or longest) DPO to leverage your vendor’s cash flow. WalMart is a master at managing cash flow through terms they negotiate with their vendors such that frequently WalMart has been paid by their customer before they pay their vendors. This is how WalMart effectively converts their vendors into their lenders. Though it is unlikely you will have the same leverage with your vendors as WalMart, you should be aware of this metric and utilize it to implement strategies to improve cash flow.

How to Compute the Cash Conversion (CCC) to Better Manage Working Capital and Cash Flow

A business’ CCC metric is analogous to the amount of time required from first dollar paid out for inventory to when that cash returns as a dollar through accounts receivable, in days. Clearly the fewer number of days required from first dollar out (or paid) to that dollar returning to the business can have a large positive impact on cash flow. The CCC metric pulls together the DSO, DIOH and DPO metrics into a single measure.

Smart Considerations When Configuring an Accounting/ERP System

This is a brief tutorial on consideration you should be making with setting an Accounting or ERP system relative to the various dimensions available to you during implementation. With a correctly configured Accounting/ERP system, you can subsequently take greater advantage of analytics tools, such as Power BI, to gain actionable intelligence and improve business performance.